In today’s fast evolving landscape of bank to customer interactions, staying ahead of the curve is essential for success. AI powered Customer Relationship Management (CRM) systems play a crucial role by optimizing and personalizing customer engagement, accurately predicting customer behavior trends, and enhancing data security, which is a critical priority for financial institutions. This demonstrates the transformative power of AI in CRM for the banking sector.

As customer expectations shift and communication channels multiply, traditional CRM systems struggle to keep pace with the agility and compliance required by modern banks. In contrast, AI powered CRM platforms are transforming how banks operate, delivering greater intelligence, speed, and precision while providing the control, explainability, and regulatory alignment that banks demand.

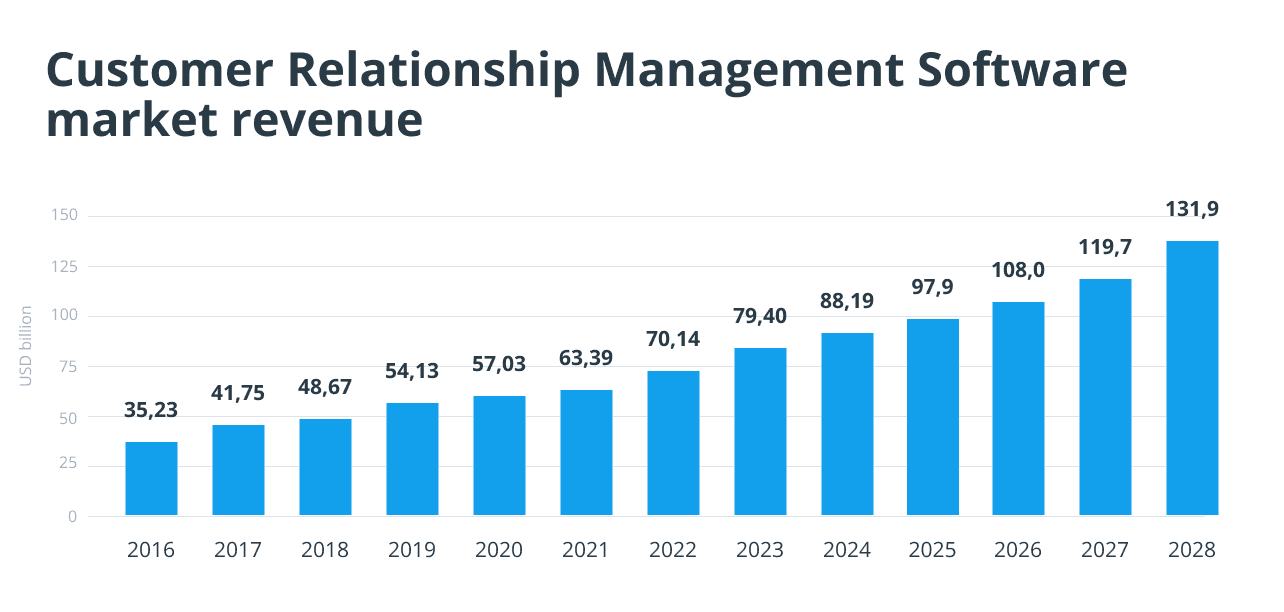

This growing reliance on AI-powered CRM systems is reflected in the significant increase in global CRM market revenue, highlighting how financial institutions are investing more to leverage smarter and more efficient customer management solutions. However, the question is, which AI-driven CRM delivers the best enterprise-grade performance, data protection, and compliance-ready flexibility for today’s banking environment?

The Disconnect: Why Traditional CRMs Still Fail to Deliver

Despite years of CRM adoption, many banks still struggle to deliver seamless and personalized customer engagement. Two persistent challenges often occur together and when combined, they create a serious roadblock to performance and decision-making.

1. Scattered Customer Context

Customer data is spread across disconnected systems, making it hard for relationship managers to get a full picture. This results in:

- Data silos across email, WhatsApp, internal CRMs, call logs, and chat platforms.

- Fragmented customer views that rely on manual stitching of information.

- Missed opportunities and inconsistent service due to lack of visibility.

- Reactive engagement instead of proactive support.

2. Passive CRM Systems

Even when data is captured, most legacy CRMs:

- Are built for record-keeping, not real-time engagement.

- Do not surface insights or recommend next steps.

- Cannot adapt to changes in customer behavior.

- Limit frontline teams from acting on intelligence in the moment.

Together, these two issues reveal a deeper disconnect between the data banks collect and the outcomes they aim to achieve. Without intelligent, real-time systems, even the most detailed CRM becomes a static tool, not a growth driver.

Adding to this, the gap between technical capabilities and business needs often leads to solutions that are either too complex to use or too simple to be effective. With different teams managing product updates and customer data, building a unified and agile system becomes even harder.

That’s where iMBrace comes in, the next-generation AI-powered CRM solutions designed to meet the high standards of the modern banking sector.

The New Era of CRM with Sovereign AI and Human-In-The-Loop (HITL)

To serve modern banking customers while maintaining full compliance and control, institutions need a smarter and safer CRM. iMBrace delivers the next-generation CRM powered by sovereign AI, built for the unique demands of the banking sector.

- Sovereign AI powered by NVIDIA, with built-in guardrails that ensure AI-generated outputs are ethical, secure, and explainable, which is critical for trust in regulated environments.

- Human-in-the-Loop (HITL) architecture provides human oversight in sensitive workflows, supporting auditability and compliance assurance.

- Flexible deployment options — cloud, hybrid, or on-premise that meet the data residency, security, and infrastructure requirements of financial institutions.

- Real time CRM intelligence built on two key data layers:

- Dynamic Knowledge Layer, which constantly updates AI with the latest product offerings, rate changes, policy shifts, and internal documentation.

- Customer Activity Layer, which unifies customer interactions across email, chat, WhatsApp, and other banking touchpoints for a complete, real time view.

- Future-ready AI capabilities that support current and emerging large language models (LLMs), allowing banks to innovate without starting over as technology evolves.

iMBrace is purpose-built for banks that demand intelligence, compliance, and full control in a single CRM solution. It combines real time customer insights with secure and explainable AI to support smarter decisions across every touchpoint. With flexible deployment and human oversight, iMBrace helps the banking sector stay agile while meeting the highest regulatory standards.

Why iMBrace is Built for Banking Decision Makers

In today’s fast-moving financial landscape, bank leaders need more than data. They require clarity, agility, and secure customer engagement that aligns with strict compliance demands. iMBrace is built for C-level executives, digital transformation teams, and frontline banking leaders who depend on real time insights to drive impactful decisions across retail, commercial, and private banking operations.

1. Enhanced Decision Making

- Real time analytics based on live customer behavior, account activity, and service interactions.

- Explainable AI recommendations to support lending, risk, and service decisions.

- Faster and data-informed actions across compliance, product, and relationship management teams.

2. Customer Centricity

- Unified view of customer interactions across email, WhatsApp, online banking chat, and branch inquiries.

- Personalized and timely support based on complete transaction and communication history.

- Stay connected across all banking channels to improve trust and retention.

3. Smarter Automation with Seamless CRM Integration

- Automates follow-ups, inquiries, and standard support replies.

- Integrates with banking CRMs and platforms like Salesforce.

- Connects securely with internal systems to streamline workflows across compliance, operations, and frontline staff.

4. Compliance You Can Trust

- Flexible deployment: on premise, hybrid, or cloud based on regulatory needs.

- Keeps sensitive financial and personal data under full institutional control.

- Supports alignment with global and regional banking regulations such as GDPR, HKMA, and U.S. financial data protection standards.

5. Ready For The Future

- Supports current and emerging large language models (LLMs) tailored for banking use cases.

- Adapts to new AI capabilities without major infrastructure changes.

- Scales confidently across branches, departments, and regions.

iMBrace is designed for modern banks and financial institutions that value intelligence, compliance, and control. With sovereign AI, seamless integration, and future-ready architecture, it helps decision makers lead with confidence and deliver trusted banking experiences.

Conclusion

In today’s competitive and regulated banking environment, AI-driven CRM is no longer optional, it’s a strategic imperative. iMBrace stands at the forefront with sovereign AI and Human-in-the-Loop orchestration, enabling the banking sector to deliver intelligent, compliant, and scalable customer engagement. For the forward-thinking banking sector looking to modernize their CRM strategy, iMBrace offers a future-ready platform designed to support long-term growth, operational excellence, and trust. Learn more on how to transform Business with AI for the Future of Modern Enterprises.