Why Insurance Agents Need iMBrace AI-Powered WhatsApp CRM to Deliver Speed, Compliance, and Trust

Overview

In today’s insurance market, trust alone doesn’t win clients, real-time engagement does.

Clients’ expectations have changed. They want instant claim updates, personalized communication, and service on the channels they already use. But most Insurance Agents are still tied to legacy CRMs and call centers that can’t keep up.

Behind the scenes, Insurance Agents also struggle with fragmented systems, scattered documents, and disconnected workflows that slow down both sales and claims. What should be a seamless experience becomes a maze of manual updates and lost context.

This isn’t just a customer experience issue, it’s a business risk. Highly digital insurance agencies grow 70% faster than less digital peers (Agent For the Future). Those who fail to modernize risk losing both trust and market share to faster, digitally native players.

Insurance Agents are exploring AI to modernize sales, service, and operations. But large, fragmented knowledge bases, lengthy validation cycles, and rollout complexity often stall progress. Starting with real-time agent communication and workflow automation is the fastest way to create measurable impact.

The Missing Link: Real-Time Customer Communication

Most CRMs give Insurance Agents strong compliance tools and reporting. But they fail at real-time engagement.

-

Claims updates arrive late.

-

Agents switch between personal WhatsApp, email, and CRM.

-

Context gets lost.

-

Opportunities slip away.

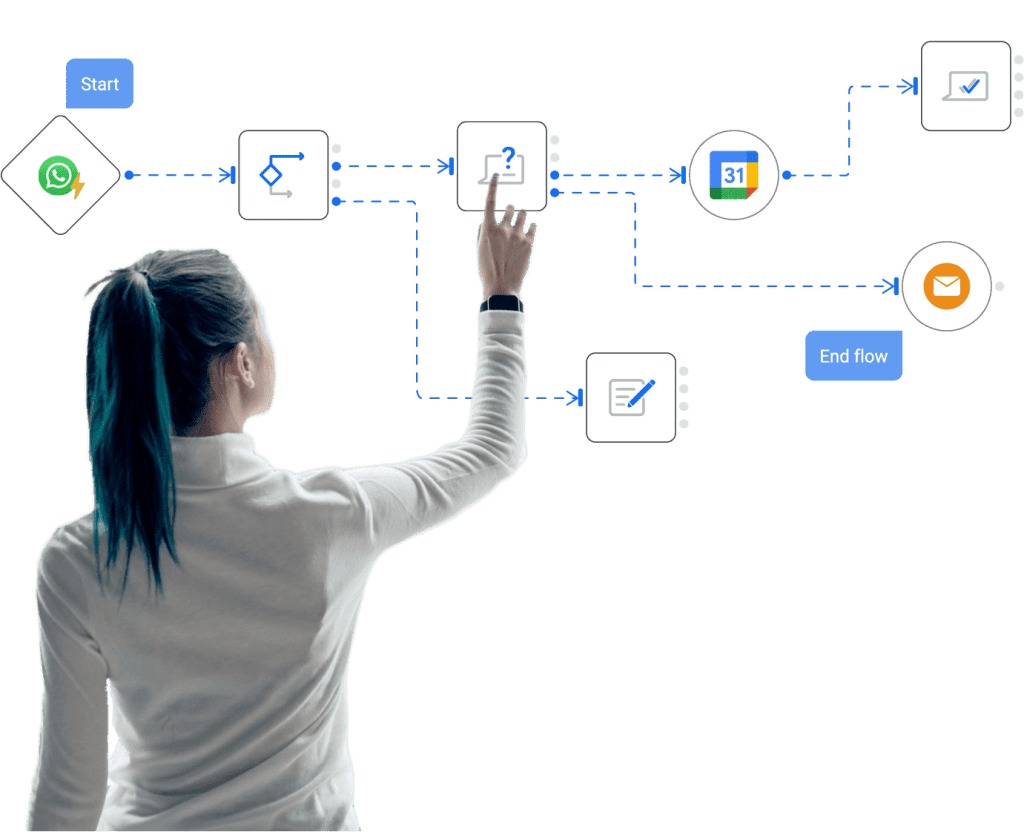

With WhatsApp built into iMBrace CRM, Insurance Agents close this gap. They can view client profiles, respond instantly, and log interactions automatically without leaving the platform. Every conversation is secure, auditable, and regulator-ready.

Why WhatsApp Matters for Insurance

Clients live on WhatsApp and that’s where Insurance Agents must meet them.

-

WhatsApp has 3 billion monthly active users worldwide (Statista).

-

66% of consumers prefer messaging apps over calls or email when interacting with businesses (Trengo).

-

WhatsApp delivers a 98% open rate, compared to ~20% for email (Bird).

-

More than 40% of financial institutions are preparing to implement messaging apps like WhatsApp (The Financial Brand).

But the value isn’t just about meeting clients where they are. For many Insurance Agents, enabling agents with instant, structured communication is the first step toward AI transformation. It lays the foundation for advanced use cases like claims Q&A, AI-driven product recommendations, and underwriting assistance.

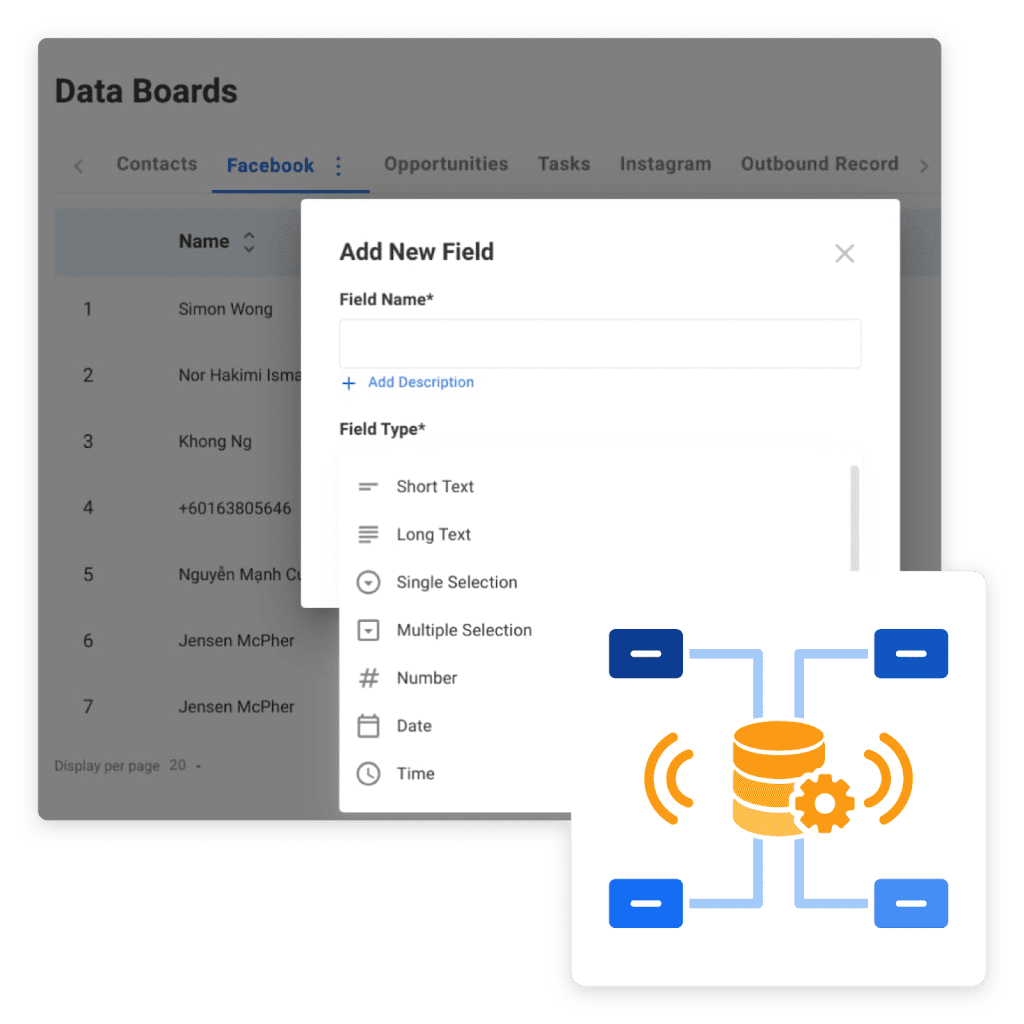

From Fragmentation to Automation: How iMBrace Data Board Transforms Insurance Workflows

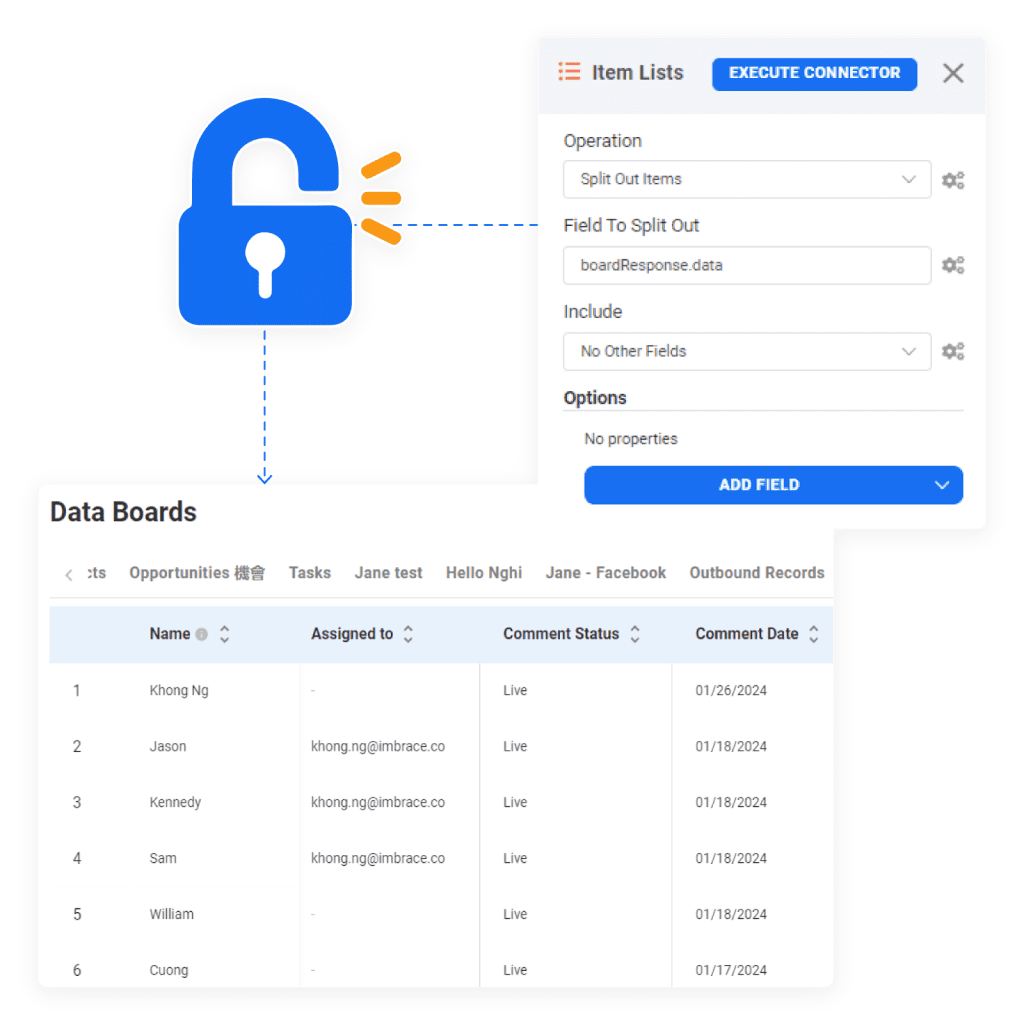

Real-time messaging is powerful, but it becomes game-changing when combined with iMBrace’s Data Boards.

The Problem: Scattered Data

Insurance Agents collect leads, claims, and client inquiries from multiple channels like email, call centers, websites, agents, and now WhatsApp. But when data is scattered:

-

It’s hard to build accurate client profiles.

-

Targeting becomes imprecise.

-

Claims and sales workflows slow down.

-

Teams waste time reconciling fragmented systems.

Before: An agent manually searches through 50+ PDF policy documents, unsure if “PA” means Personal Accident, Professional Agreement, or something else. By the time the context is clear, the client is already frustrated.

After: iMBrace Data Board + WhatsApp surfaces the right policy context instantly. If the query requires escalation, the agent can seamlessly hand over to the right team with context preserved.

Unlike generic chatbots that depend on untuned RAG systems, iMBrace structures data upfront. This avoids common insurance PoC failures such as:

-

Tuning complexity across fragmented documents

-

Terminology mismatches across policies

-

Validation cycles that stall AI rollouts

With iMBrace, every WhatsApp conversation feeds structured, actionable intelligence directly into workflows, enabling automation today while preparing clean data for tomorrow’s AI use cases.

Why It Matters for Insurance Agents

A client submits a claim → iMBrace automatically updates the Data Board, triggers claim team workflows, and sends a WhatsApp confirmation instantly.

A renewal date approaches → automated WhatsApp reminders go out, while Insurance Agents receive AI prompts to upsell coverage.

A client inquiry arrives → the Insurance Agent sees full profile, history, and recommended responses in real time.

This isn’t just data management. It’s data-driven engagement, turning every WhatsApp conversation into business value.

Business Impact for Insurance Agents

By combining WhatsApp integration with iMBrace Data Boards, Insurance Agents achieve:

-

Faster Claims, Stronger Trust: Clients receive updates instantly, reducing frustration.

-

Lower Operational Costs: Automation eliminates manual coordination, freeing up agent capacity.

-

Higher Retention: Instant, personalized messaging boosts loyalty in a competitive market.

-

Smarter Decisions: Every chat becomes structured, actionable data that powers better underwriting, marketing, and service.

-

Regulatory Confidence: Secure logging ensures compliance in every region.

For Insurance Agents, the fastest path to AI value isn’t deploying massive RAG systems right away, those often get stuck in months of tuning and validation. Instead, the smarter approach is to start with structured automation around real-time communication.

With iMBrace CRM + WhatsApp integration, Insurance Agents achieve:

-

Quick wins through automation (summarization, reminders, workflows)

-

Immediate ROI via faster claims and clients retention

-

A clean, structured data foundation to later scale into claims Q&A, underwriting support, and AI-driven product recommendations

This pragmatic rollout strategy ensures that AI adoption is both measurable today and scalable tomorrow.

Conclusion

Insurance leaders know clients’ expectations won’t slow down. Clients want speed, transparency, personalization and they want it on WhatsApp.

With iMBrace CRM’s WhatsApp integration and Data Boards, Insurance Agents can finally deliver real-time, compliant, and client-first experiences at scale. The result? Stronger client trust, faster claims, and measurable business growth.

👉 Ready to transform your insurance operations? Schedule a demo now!